The 1970's This Is Not

This is a debt-driven asset bubble, and Bitcoin is its eventual heir.

We are a product of our youth. My youth was an era of inflation — an era of shockingly high gas prices and long lines at the pumps. Of futile gestures – like the WIN buttons of Gerald Ford, for “Whip Inflation Now”. I liked Gerald Ford. You could trust him with democracy.

The 1970’s was the stale end of a post-WWII industrial dividend paid to the United States for winning that war unscathed, that ceded to us a dominant share of global manufacturing, populating myriad Midwestern towns with flourishing factories and empowering unionization that fostered the famed middle class. Auto workers, steel workers, coal miners. Good jobs. All of that plus an ongoing spend on defense in the throes of the cold war. Until it became hopelessly anachronistic in the face of global competition. We lamented the ensuing evisceration of our manufacturing base. Not even Reagan’s Morning in America could bring it back to life. Pay a visit to lamentable post-industrial small-town Michigan, Indiana, Illinois, Wisconsin, Ohio. Take a peak in the back of the gas station at the slot machines.

We were entering a globalization era of massive disinflation. On a tour of manufacturing facilities in Guadalajara in 1999, the plant manager at a large company told me that manufacturing in Mexico cost one-fifth as much as Denver, but that China was even cheaper. “How cheap is China?” I asked. “It is one tenth the cost…of Mexico,” he said. Then came the sucking sound of manufacturing and intellectual property flowing to the mainland. And massive expansion of an economy that suffocates dissent, traps capital, and deploys debt to subsidize low-return industries. Now more than ever to the service of a militaristic, nationalist agenda of expansion. Lucky us for all the cheap electronics.

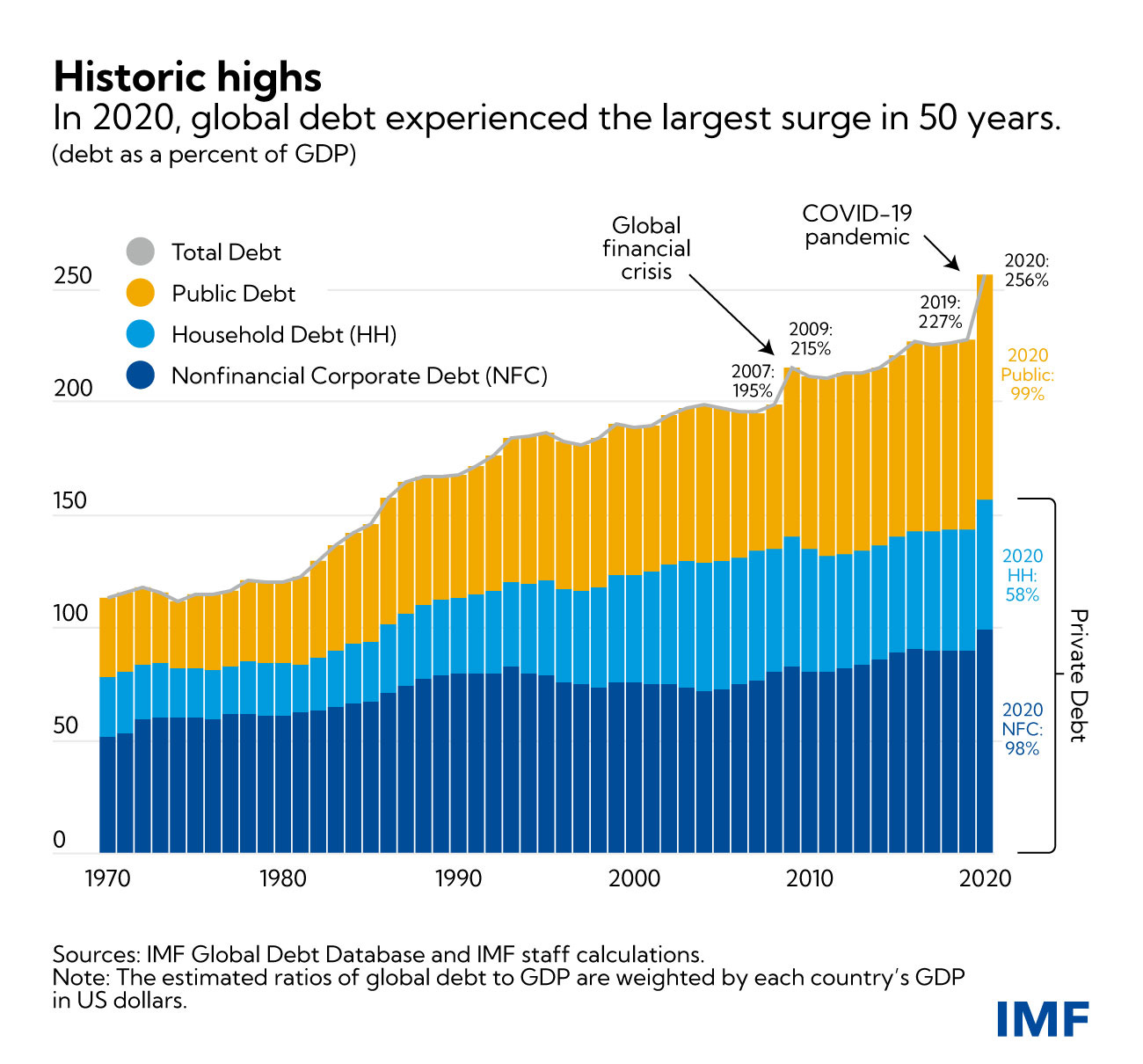

But always present during this massive change has been one particular thing. Born into inflation in the 70’s, flourishing in the 80’s during recession, and growing relentlessly into full flower globally without pause has been our dependence on demand financed by debt. A global record $226 trillion per the IMF. This debt represents demand. It is indispensable to demand. This is not news to you:

Whatever inflationary forces may be in place, they drain into a deflationary sewer if for some reason – any reason – our ability to spend is constrained to our limited means.

We are fascinated by ephemeral disruptions in supply chains that spawn shocking rallies in components and commodities. But capital formation follows. Inexorably. Unbounded. It is always transitory. Especially when an expert tells you it is not. Do not mistake those bottlenecks for structural inflation. Not that kind. That does not exist. On the other hand, the kind in Turkey or Argentina, driven by a currency crisis? Yep, that happens, and it is likely to recur.

We launched a fiscal and monetary nuclear missile at the Covid crisis — a very good reason. And it spawned a massive asset bubble, as we marveled at the impact of negative real rates on our DCF valuations. And now with the prospect of positive real rates, we are unwinding that. But the real rates are minuscule. The 10-year TIP yield is only 23bps. And the 10-year breakeven (the 10-year Treasury Bond yield less the 10-year TIP yield) already has come down to a 2.6% implied rate of inflation. And wage pressures are associated with fast food restaurants, not heavy industry. Because the structure of this economy not only depends on a punch bowl for an attractive return on investment, it depends on it for demand. Does this look like intractable inflation to you?

The 10-year Breakeven Rolling Over

The further we go down this road, the more ridiculous it becomes to imagine we could ever find our way back. And that is my preferred fundamental bull case on Bitcoin. You can get distracted by other issues: power consumption, government hostility, regulatory uncertainty, or the ultimate bogeyman -- illicit trade (because that never happens in dollars). It is all beside the point. Fiat currency is a crutch. In fact, it is a wheelchair. While the Austrian economists are babbling senselessly in the asylum of fiscal conservatism, they have a stalking horse.

Bitcoin is scarce. It is limited. It is usable, and becoming more usable. And in an early stage of adoption. It is becoming indispensable. And in the rhetorical words of SkyBridge President Brett Messing, ask yourself this: “Will more people own Bitcoin next year, and the year after, and the year after that?”

Logarithmic multi-year chart of Bitcoin in dollars.